Realization

Rescuing having yet another house can seem to be such a keen insurmountable challenge, specifically for first-day buyers. Exactly what brand of wide variety extremely need to be considered? I look at off money, home loan insurance coverage, settlement costs, and much more.

American singles, people, family members, at some point almost everyone turns their financial attention to to purchase a home. But how much do they really need to save yourself, the first time aside? Exactly how much is sufficient to handle the newest generally high contour out of off costs and you can closing costs?

With regards to preserving getting a house, you can find helpful recommendations. But, there are even alternatives for buyers who are in need of a feet right up. Let us glance at the principles, and many workarounds, offered techniques you to definitely basic-time customers can take of having from door out of its basic home.

Buying your Brand new home: Offers and you may Criterion

Really real-estate pros will tell you to possess at the very least 5% of your own cost of a property on hand inside the offers so you can account for the fresh advance payment. But that’s simply at least, and you may criterion may vary by community.

For the a region such as Ny, instance, lowest off costs have been 20%, believe it or not. And even whenever you can secure home financing because of the getting down below 20% of cost, you’re likely causing required mortgage insurance coverage that is why. Financial insurance rates, however, need not be a primary obstacle.

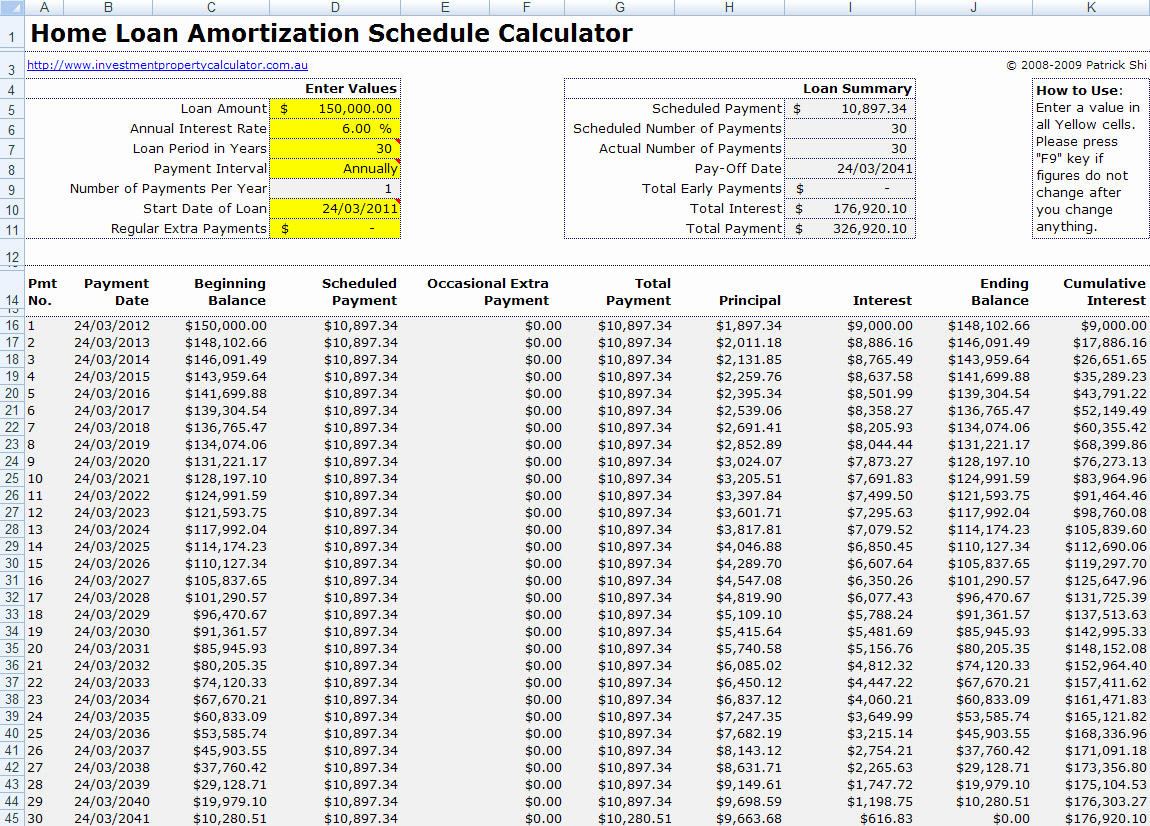

In general, homeowners who shell out lower than 20% within down-payment need to pay home loan insurance policies up until the loan-to-well worth ratio is actually 80% . Therefore, for folks who borrowed $270,100 towards the a good $3 hundred,one hundred thousand household ? to put it differently, your own down payment came to 10% ? their LTV might possibly be ninety% (which is, the loan number, $270,100000, separated by the cost of our house, $three hundred,000). Their monthly installments thereon rules would continue if you don’t paid the mortgage off by another $30,one hundred thousand, so you’re able to a balance away from $240,000 ? otherwise, 80% of your own full price.

The amount of your own financial-cost depends on your credit rating as well as the size of the downpayment. Sometimes, with respect to personal loans, mortgage insurance operates on the 0.3%?1.15% range . Inside our earlier in the day example, their month-to-month insurance rates commission will be certain $68?$259.

Thereby, toward a thirty-12 months home loan, the homebuyer, provided a great borrowing from the bank profile, create undertake just as much as $step one,762 into the monthly obligations (during the a beneficial 5% rate of interest, including 78 financial-insurance rates repayments of around $113 in the 0.5%, and you will merging property income tax to your repayments at step 1.25%). That’s predicated on a primary deals of $31,100, made use of once the an advance payment on the an excellent $three hundred,100 home.

Note, when the our homebuyers got stored $60,100000 on the downpayment, its monthly bill would get rid of for some $step one,600, eliminating the necessity for mortgage insurance coverage. Yet not, inside our model, financial insurance makes up just $1,356 annually over 6.5 years about $sixty,000-down-percentage instance ? or $8,800 full. Looks like which is not nearly as expensive saving the excess $29,000 hitting the fresh new 20% down-payment draw. Thereby, in the event that savings is problematic, first-big date consumers might take on the insurance rates in return for an excellent lower down fee.

Settlement costs: First-Day Consumers Beware

Settlement costs usually are costs getting profits, appraisals and you will surveying; inspections and you will qualifications; income tax and you will identity services, authorities listing transform, and you will transfer taxation. you will shell out a keen origination commission towards the mortgage lender, and a payment for certain interest levels.

Other variables can also come into play. Inside a major town co-op, you happen to be necessary to has per year or higher of maintenance fees in the financial. And you can, in the end, remember the tail-end of every home buyers’ experience ‘s the move ? definition, much more expense also.

First-date homebuyers are sometimes shocked when they observe how settlement costs adds up. The typical amount will come to a few step 3% of one’s cost of the house, and you may focus on the whole way doing 6% . Because variety, its a wise idea in the first place 2%?dos.5% of your total price of the house, for the coupons, so you’re able to be the cause of settlement costs. For this reason, all of our $3 hundred,100 earliest-big date homebuyer should sock out throughout the $six,one hundred thousand?$7,five hundred to cover the right back-prevent of the to shop for sense. Tallying the coupons our company is speaking in total, thus far, extent involves $thirty-six,100?$37,five hundred.

To the initial offers to possess good $3 hundred,000 house, it’s also advisable to tuck out adequate to make sure people unexpected twists and you can converts is actually accounted for when you transfer to the new household. A sensible goal is to think of one barrier given that an effective half-12 months out-of mortgage repayments. That will be $10,572 to the buyers in our very first $three hundred,000-at-10% model ? all in all, $46,572?$forty eight,072 from the bank just before closure a package.

If the saving getting an initial house appears a mountain also high, need cardiovascular system. Direction software might help. You start with agreements at the government top, these can slice the first coupons needed because of the a dramatic number.

Based possessions place or any other, private issues, you could potentially be eligible for a home loan throughout the Federal Property Government. Quite often, you’d be expected to create an advance payment around step three.5% (having a 1.75% top, and at an excellent 4.25% rate of interest). An advance payment for the the $3 hundred,one hundred thousand model: $ten,500. In addition to closing costs and you can a shield, deals needed could be $twenty six,916?$twenty eight,416. Notice, yet not, that you will be using more compared to this new low-FHA design if it arrive at the higher home loan-insurance premiums? certain $43,485 more 103 days. Still, new FHA package can be so much https://simplycashadvance.net/title-loans/ more manageable for the majority of, as the initially down payment is faster and you can insurance payments was dispersed.

Specific pros, active people in the newest armed forces, and you may qualifying residents away from designated rural areas normally qualify for a beneficial 0% down-fee housing financing ? mortgage-insurance rates 100 % free too ? on Veterans Management or even the You.S. Department out-of Agriculture. In this situation, first-day homeowners you will walk into an excellent $3 hundred,one hundred thousand domestic just for the latest settlement costs, in addition to ideal half dozen-day shield.

What’s obvious would be the fact homeowners has possibilities, and while the fresh new coupons required to score a first domestic can total on the mid five rates, they are able to arrive around the middle-twenties. There are even guidance plans provided by Federal national mortgage association and you can Freddie Mac, featuring thirty-five% off money, each come with her benefits and drawbacks. First-date homeowners must also explore state and regional arrangements. The analysis your put money into the process ahead of time is also considerably connect with what you need certainly to cut back in advance of turning the key to the new front door.