You might have to operate easily to eliminate lost a fees and you can defaulting to the an unsecured loan. According to the situation, you might explore a way to treat other expenditures, refinance your debt otherwise rating help from the financial or a good borrowing therapist.

In this article:

- When Try an unsecured loan when you look at the Default?

- How to prevent Defaulting to the an unsecured loan

- What are the Effects from Not Paying down The loan?

While you are struggling to afford the expense and you will imagine you might miss the next personal loan payment, you need to compare your options ahead of it’s far too late. Shedding behind and finally defaulting to the mortgage can result in more charges and you may damage your borrowing for decades. You might be able to get assist or avoid the later percentage if you operate rapidly.

When Are a personal bank loan from inside the Default?

Your loan may commercially enter standard when you initially skip a payment, since you might be failing to follow through into the terms of the financing contract your closed. However, many signature loans (or other individual funds) features an elegance period ahead of a repayment is actually reported on credit agencies since later.

Despite new elegance period has passed, loan providers can get consider carefully your loan delinquent for a period of time prior to declaring they when you look at the default. How long the loan is known as outstanding depends on the lending company, however, always just after 3 to 6 months, it would be sensed in standard.

Steer clear of Defaulting for the a consumer loan

There are several indicates you happen to be in a position to prevent destroyed your financing fee, but the best approach is based on your position.

For example, if you cannot pay for a costs that it week because of an excellent one-date setback, dipping toward an urgent situation funds or briefly depending on a credit cards can make sense. But when you have a much trouble to own months ahead, you can maintain your crisis finance to have important expenses (such as property and you may food) and consider other choices or brand of guidelines.

Feedback Your financial budget and Scale back

If you’re able to reduce expenditures, you will be capable free up currency you might place into your loan payments. Remark your financial allowance or latest bank and you will credit card statements in order to score a sense of how much cash you will be expenses and you may in which your own cash is supposed. Whenever you are lowering is not fun, to prevent a belated fee will save you money, and you will maintaining your a good credit score can give you way more monetary choices subsequently.

Get hold of your Bank

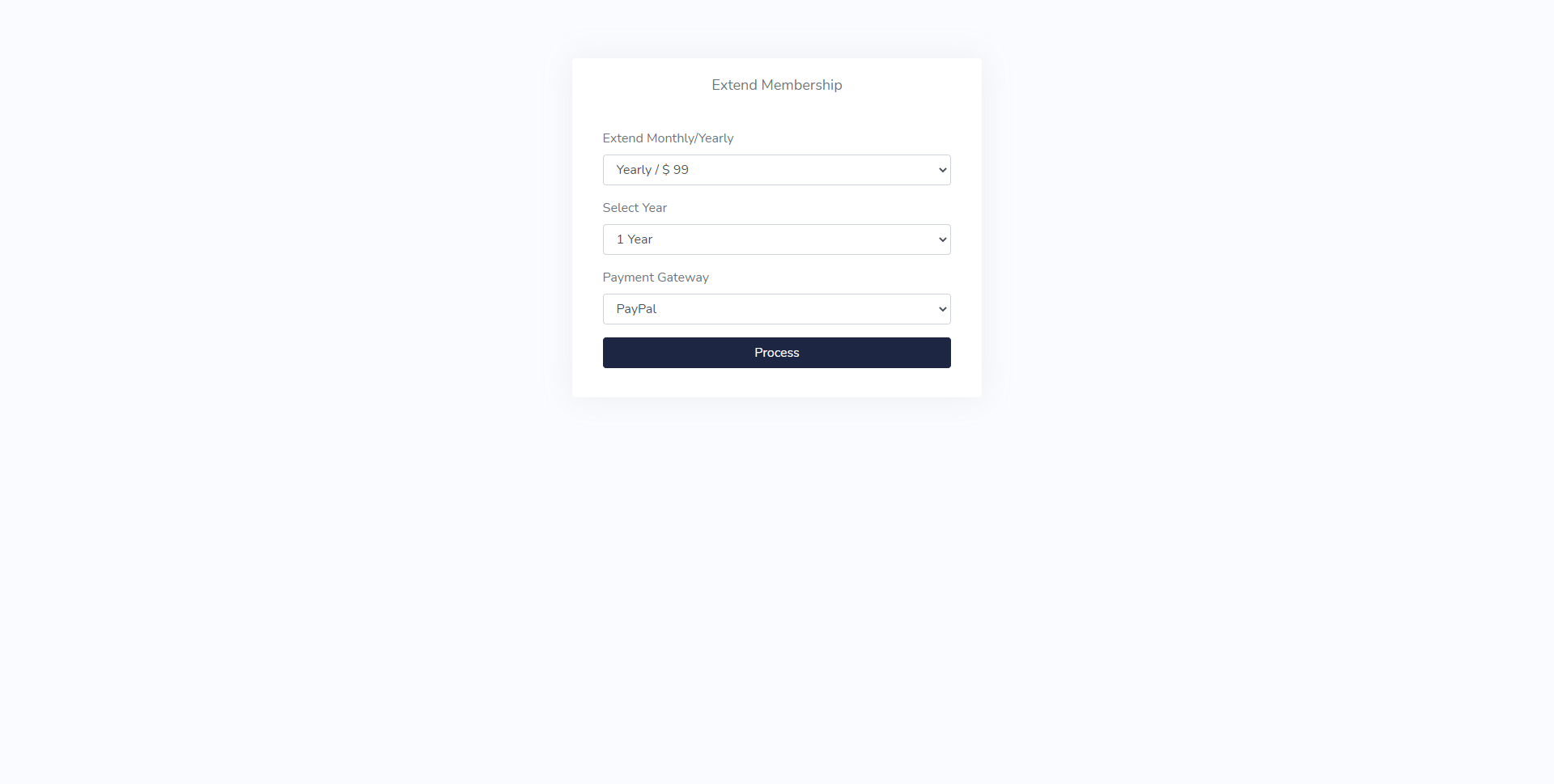

Whenever there is absolutely no relocate space in your finances otherwise you are dealing having an urgent situation situation, instance a missing occupations or unexpected medical expense, reach out to your financial instantly. The organization s, such as for instance clickcashadvance.com tribal installment loans direct lenders no credit check a temporarily straight down interest or payment per month, or a temporary stop on your costs.

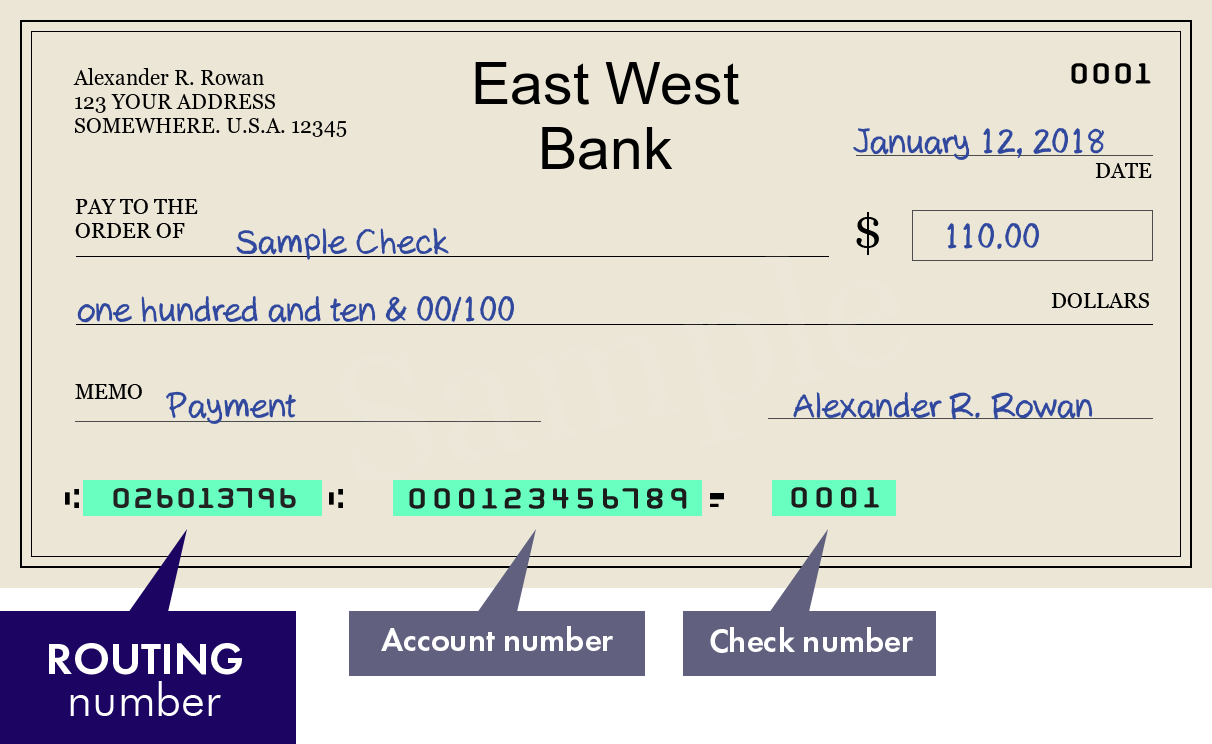

Refinance or Consolidate the loan

For those who have a good credit score, you may qualify for an alternative loan you can make use of to help you refinance or consolidate costs. Your own monthly obligations you certainly will drop off whether your new loan has actually a good straight down interest rate otherwise offered installment title. If you find yourself moving personal debt from 1 bank to another isn’t really a lasting long-identity strategy, it may make you adequate respiration room to catch through to their expenses and avoid defaulting on your financing.

Use an equilibrium Import Mastercard

Just like playing with a special financing, some handmade cards promote a promotional 0% annual percentage rate (APR) on balance transfers. Several cards along with enable you to transfer a balance towards bank account, and you can upcoming use the money to pay down otherwise from the consumer loan. It could be easier to make charge card repayments and you can pay down your debt once the bank card isn’t really accruing interest.