step one. Financing a cellular household from inside the Georgia are going to be challenging, but there are many available options knowing in which to look. Here are some these choices:

Alternative step one: You to definitely option for investment a mobile house is due to a personal financing. You can purchase a personal bank loan out-of a bank, borrowing union, otherwise on the web lender. The speed into the a personal bank loan hinges on their credit history and finances.

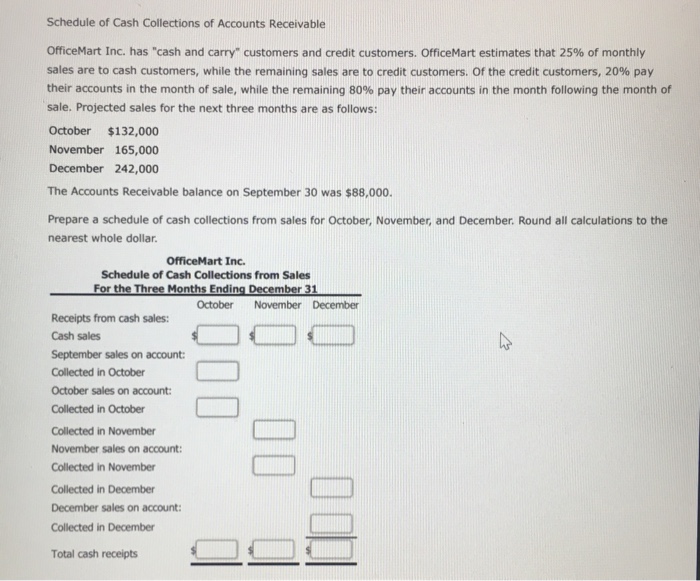

Alternative 2: Another option having money a cellular home is as a consequence of a lender has been a home loan. You will have to provides a good credit score in order to qualify for a mortgage, as well as the interest rate could well be greater than having an individual loan. But not, you happen to be able to get a lowered interest if you devote off a more impressive down-payment.

- The new mobile household should be a minimum of 400 sqft or higher.

- The latest mobile domestic must have already been depending shortly after Summer fifteen, 1976, plus satisfy Federal Are created Home Framework and Coverage Conditions (you will find a certificate label for this).

- Brand new cellular household need to be toward a permanent foundation and cannot be found into the a cellular home park.

- The borrowed funds might also want to defense the newest house about what the brand new are available household is.

Alternative 3: If you aren’t sure and that finance choice is best for you, correspond with a financial advisor or homes specialist. They can help you understand the choices and select an informed answer to financing the mobile household.

Given that we’ve got reviewed certain general tips about how to funds a cellular domestic from inside the Georgia, let us dive into some facts. Even as we discussed earlier, you to definitely option for investment a mobile residence is by way of a personal financing. You can get a personal bank loan away from a bank, borrowing from the bank commitment.

dos. How to funds a mobile residence is to locate that loan out of a financial or borrowing partnership.

When you find yourself resource a cellular home, it’s important to check around and you will compare interest rates of more loan providers. Definitely evaluate interest levels and you will terminology before signing any papers before you can agree to some thing. You ought to get the best offer you’ll be able to, so be sure to find out about discounts or special offers.

When you yourself have good credit, you might be in a position to qualify for a lower interest. However, in the event your credit score is not delicious, you may need to shell out a top rate of interest. loans in Pine Level For this reason it is very important evaluate prices out-of some other lenders ahead of you select that.

You may want to consider a longer loan name in order to fund their mobile house. This will lower your monthly payments, however you will shell out way more inside the desire along side longevity of the brand new loan. Additionally, it is a good idea to score pre-approved for a financial loan in advance looking a mobile domestic in Georgia.

>> Take a look at the greatest cellular lenders during the 2022 from Investopedia. Cellular Household Went are a cellular domestic broker on state off Georgia giving reasonable options for cellular homebuyers!

Understand that you’ll likely have to pay a higher interest and might need certainly to set out a much bigger downpayment for people who financing as a result of a cellular family agent or broker. However if you will be having problems getting approved for a loan, this may be your best option for you.

cuatro. Always look at the fine print and ask inquiries or even discover some thing before you sign one paperwork.

If you are investment a mobile household, it is vital to know most of the small print of one’s mortgage before signing some thing. Make sure to read the conditions and terms and ask concerns if you will find all you do not understand. You don’t want to make any problems which will charge a fee extra money eventually.

If you’re not yes hence financing choice is right for you, correspond with an economic coach or good Georgia construction therapist. They could make it easier to know the options and select a knowledgeable cure for finance your own mobile house.

Now you see a number of the axioms throughout the financing an excellent mobile home inside the Georgia, it’s time to begin looking around to discover the best offer!

Get more info Into Options to Offer Your home.

Attempting to sell a property in today’s market will likely be confusing. Affect you or fill in the information below and we will assist make suggestions throughout your solutions.