- Fine print

When you fill in the application, you’ll discovered numerous now offers of multiple loan providers. These types of also provides get some terms and you may interest rates (APR). This type of conditions and terms usually takes the form off papers otherwise an item of text.

Ahead of agreeing to virtually any financing give, be sure to see clearly double. You can find three things should always be looking to have. The first is undetectable conditions in the contract. The next step is choosing just how long it will take to help you pay the bucks. Accept for folks who agree with the agreed-upon big date. In the long run, you need to determine if you could pay off the loan timely.

Exact same Time Money Faqs

Its that loan registered on the same big date it is used. Also known as emergency financing and pay day loan . To begin, you must request a loan away from an online home loan company. You will located also provides Bear Creek loans regarding several lenders after submitting the application. Also, each lender will give you proposals having varying conditions and terms.

Its upcoming for you to decide to accept the deal you to definitely greatest suits you. The cash is oftentimes transported for a passing fancy day just like the software. Or even, it is obtained the following business day. Although not, the eye rates with the financing is more than normal. That’s why we encourage one to incorporate if you are certified.

Q2. Which are the standards of app?

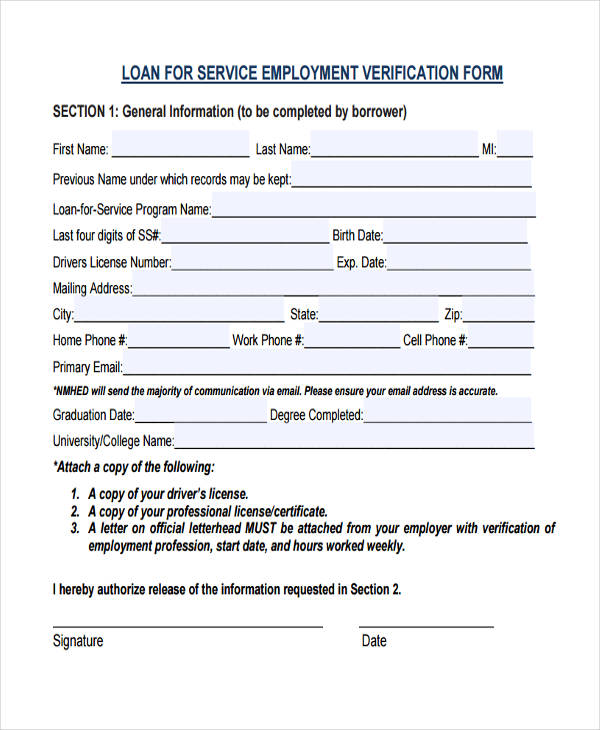

The lenders have a tendency to pose various issues to you personally because you complete the web loan application. These inquiries tends to be individual otherwise economic into the profile. There is certainly a go that the inquiries to the application will differ from that company to the next. Very loan providers, but not, wanted their title, societal safeguards amount, address, and contact info, particularly an email.

Furthermore, documentation guaranteeing youre a resident of your Us are expected. Perhaps one of the most commonplace issues means a job record, mastercard need, and a typical source of income. Keep this information convenient if you’d like to receive a loan out of any of the enterprises in the list above.

Q3. Will this financing affect my credit history?

Yes, same date otherwise whichever mortgage you will effect the borrowing card score. If you find a beneficial bank, loan repay will help you to boost your credit rating. In addition, if you can’t pay-off the mortgage on time, your credit rating will suffer.

This means that, obtaining loans out-of on the web lending organizations is preferred if you possibly could repay her or him on time. Also a little bit of money lent and you can returned timely you’ll improve credit rating. Some individuals can get participate in this conclusion to boost its credit score.

Q4. How much cash should i use?

The firm find the amount of currency you could potentially borrow. Sometimes you receive the specific matter you prefer, however, some days, youre approved for a lower life expectancy matter based on their background.

For the majority items, you might demand financing to possess only $600 so when much as $ten,000, or more inside unusual times, such $20,100000 otherwise $31,100. Financing exceeding $fifty,100 are not available below one circumstances, no matter what program.

Q5. How much time up until my financing is approved?

Might give the loan a comparable big date your pertain. After you apply for a loan as a consequence of one of the needed other sites, the job is instantly forwarded so you’re able to prospective lenders. Opinion and you will approval simply take a couple of hours.

If for example the software program is approved, one or more loan providers often get in touch with you to discuss the mortgage standards. You’ll get the money on the afternoon your technically agreed in order to they.