Inside historically low interest rate ecosystem, the latest Virtual assistant Financial system makes to purchase a property significantly more sensible than ever before for an experienced army veteran.

The new Va financial system is lead within the 1944 to greatly help pros convenience back once again to civil existence after The second world war. It actually was an excellent lifeline for males and you will women who hadn’t started able to establish borrowing otherwise save getting an advance payment when you are offering in the war. Ever since, more than 20 billion fund were protected by Service off Experts Factors.

The current veterans and you will productive duty provider players continue steadily to enjoy this new benefits of the newest 75-year-old-mortgage system. As well as going back a decade, Virtual assistant financing are ever more popular. More than forty% away from regulators-supported mortgage loans is Va funds, as compared to 16% a decade ago, centered on Ginnie Can get.

Va lenders are one of the foremost monetary pros in regards to our army servicemembers, told you Ben West, Military Affairs movie director having Zions Lender. This type of fund render all of our nation’s pros the opportunity of homeownership that have of many important masters that frequently score overlooked.

Western, that is also a chief and you will Organization Frontrunner from the Armed forces Federal Guard, received his very own Virtual assistant Home loan because of Zions Bank and enjoyed the information and you may proper care his home loan administrator added to the fresh loan procedure.

Trying to get home financing is a frightening task that be challenging to navigate for these fresh to the procedure, the guy said. As lenders, we should instead step up and be prepared to let all of our pros understand the procedure and the pros they could receive due to a Virtual assistant loan.

Particularly conventional finance, Virtual assistant money is issued from the personal lending institutions and you will subject to credit acceptance. But instead of conventional money, he is supported by the latest Pros Management (VA), which often allows loan providers to unwind credit conditions. The loan allows a qualified necessary hyperlink veteran, servicemember or thriving mate financing 100% of one’s cost of a home versus a downpayment and doesn’t need individual home loan insurance. Other types of finance usually only loans as much as 95% out-of a great house’s really worth consequently they are necessary to receive personal insurance.

Va Home loan Virtue #2: Zero minimum credit history requirements

Than the antique mortgages, Va Home loans promote much more easy assistance for applicants. There are not any minimum credit score conditions on Virtual assistant. Debt-to-income ratio plus does not plays a role in the application form processes. Instead, loan providers opinion what kind of cash borrowers have remaining more for each and every times right after paying all their expense, labeled as continual earnings. While doing so, the brand new Virtual assistant and additionally takes into account credit re-dependent when a borrower has actually 2 years regarding clean borrowing pursuing the a foreclosure or bankruptcy proceeding.

Virtual assistant Financial Advantage #3: Lower interest rates

The pace towards the a Va financial is generally straight down than the a non-Va home loan, giving consumers more screw because of their money.

Va Home loans Give Domestic Refinancing Choices

The key benefits of Virtual assistant fund extend not just to brand new building or to buy a house, and in addition so you can refinancing or improving your domestic. Indeed, VA-supported mortgage loans increased from inside the 2020, passionate because of the an almost 600% increase in rate of interest refinance financing all over the country.

By way of record-low interest rates, hundreds of thousands of veterans, services professionals in addition to their survivors was able to re-finance their Va finance on a lesser rate of interest inside the 2020.

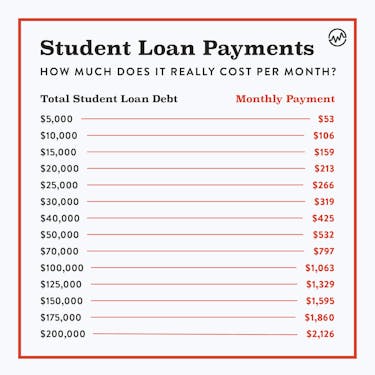

For those who have an existing Va-supported financial, mortgage cures refinance loan (IRRRL) helps you lower your monthly home loan repayments or stabilize the money. It can be used to refinance a variable-rates financial into a fixed-price mortgage, provided the fresh financial keeps a lower interest. As an alternative, a beneficial Va cash-aside refinance mortgage allows you to bring cash out of your home to pay off personal debt, lower figuratively speaking, generate home improvements, otherwise satisfy almost every other means.

Remember that, as with any financing, interest levels into the good Va IRRL otherwise Virtual assistant dollars-out refinance loan will vary between lenders, and you may should make sure you understand how the new amount borrowed refers to the worth of your house.

Consider the huge benefits and Cons off Virtual assistant Financing

No currency off, reduced closing costs and no monthly home loan insurance premium, Va funds promote high initial coupons. But they ple, in case your servicemembers have enough to possess a down payment away from within the very least 20% of your own cost from a unique domestic, a normal mortgage could make alot more sense. This is because extremely military mortgage loans incorporate a beneficial Virtual assistant money commission – a one-time fees calculated given that a portion of your own loan amount into the lieu of mortgage insurance coverage. That have a beneficial 20% down payment into a normal financing, you simply will not be asked to get home loan insurance coverage – and avoid the Virtual assistant financial support percentage.

Most other Factors to learn

Virtual assistant Financial Fact #1: You should buy a great Va financing at any age. Certification derive from length of time served and you may obligation updates, it doesn’t matter what way back you served. The nation Battle II veterans Virtual assistant funds was in the first place designed for are qualified now. Learn about Virtual assistant mortgage qualifications standards right here.

Virtual assistant Mortgage Truth #2: You could recycle the bonus multiple times. Whether or not you get moved or want to move to some other house, you can make use of a great Virtual assistant financing over repeatedly. Normally, you’ll want to offer our house and you will repay the original loan so you can re-use the work with. not, qualified anyone is also found a one-time repair when they pay the Virtual assistant financing but continue the home.

Va Mortgage Truth #3: Not every person pays brand new Virtual assistant capital fee. Va money generally speaking costs a financing payment anywhere between 0.50% and you will 3.6% of the loan amount, based provider records together with mortgage types of. not, you happen to be capable steer clear of the one to-time funding payment for many who see certain requirements. Including, handicapped veterans who happen to be receiving settlement to have an assistance-connected handicap try exempt. Likewise, the thriving spouse away from a seasoned exactly who died in service or regarding a support-linked handicap, otherwise who had been completely disabled, could have the fee waived.

Help Zions Financial assist you with good Virtual assistant mortgage*. Our experienced home loan officers are quite ready to let whatsoever degree of processes. They understand the significance of the Virtual assistant Lenders and are also eager to assist the military experts see their home control hopes and dreams.

Enabling the servicemembers go into a home is a small way we could express gratitude for everybody that they have complete in regards to our country, Western said.